Dopex as a Baseplate

There is never a dull moment in Decentralized Finance (DeFi). Since its inception, this subset of crypto has grown from humble beginnings to a sector with over $200 billion TVL across various chains at its peak. Building off the back of vampire attacks, rampant food farms, and a new breed of degen trader - the mercenary farmer - DeFi has produced a competitive landscape that evolved quite a bit in such a brief span of time.

DeFi 1.0 was characterized by the launch of innovative protocols like Yearn Finance, Uniswap and Aave. Before then, there wasn’t a lot you could do with your crypto wealth besides sell it back to fiat or hold it in a wallet. Earning yield on your tokens was a pipe dream, but with the extremely attractive incentives from liquidity mining and the narrative of DeFi summer, the sector took off.

DeFi 2.0 took a little bit longer to come to fruition with protocols like Olympus and Wonderland leading the way with their sky-high APYs and rebasing token mechanisms. As DeFi 2.0 continued to dominate market participants’ attention, the Curve Wars became one of the biggest narratives the cryptocurrency market had seen yet. veTokenomics and protocol-owned liquidity (PoL) became necessities, with a myriad of protocols copying Curve’s innovative tokenomics and far too many Olympus forks popping out of the woodwork.

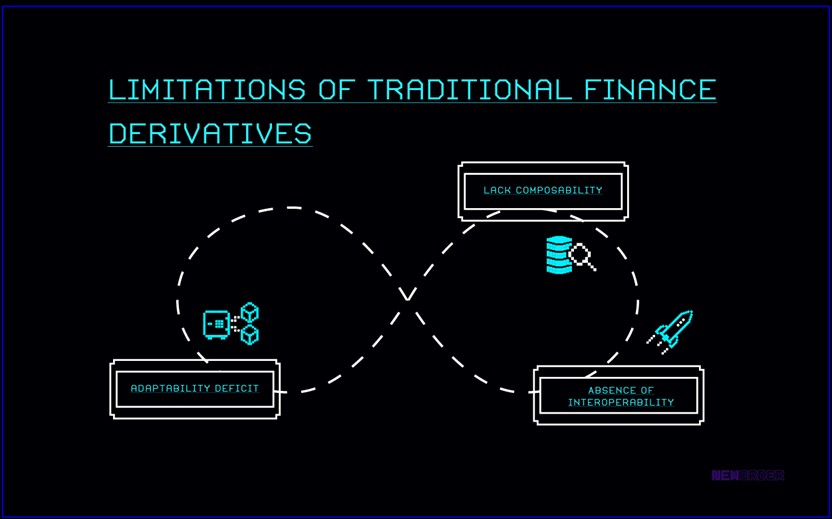

Even though DeFi 2.0 came to a screeching halt as the broader market turned over, a new narrative has begun to emerge — this of course being DeFi 3.0. Where liquidity mining and PoL were once king, a new idea has begun to make its rounds: one that focuses on the development of more efficient and equitable user incentives. These incentives are made possible by three traits that we view as the characteristics of a strong protocol: composability, adaptability and interoperability. By building on this foundation, placing the user experience first, and putting an emphasis on delivering a useful product, protocols can establish their moat in a shifting DeFi landscape.

The past two years have been a wild ride in the world of DeFi. If these past few months are any sign of what's to come, 2022 and the advent of DeFi 3.0 will exceed all of our expectations — and there are few areas in which this is more true than the explosion of DeFi derivatives.

TradFi derivatives products

For the unaware, a financial derivative is a product that derives its value from an underlying asset, typically used in more complex financial strategies between two or more parties. Traditional Finance (TradFi) derivative products include options, futures, collateralized loans, and prediction markets. One of the more popular financial derivatives is the option: a contract that gives the holder the right to buy or sell an asset at a predetermined price by a given date. You may have heard a lot about these after the WallStreetBets fiasco. Still, options are much bigger than a retail fad and represented over $33.31 billion traded in 2021 alone.

Crypto has grown its total market capitalization to around $2 trillion at its peak without the widespread availability of options. While TradFi markets are highly efficient and leave little room for error, crypto is another story. Whether it be MEV, a hidden low cap gem, or general scarcity of free capital, opportunities slip by in crypto on an almost daily basis. Even though products like perpetual futures contracts are available on exchanges and there are some methods of gaining options exposure, the lack of on-chain availability has left much to be desired in a space dominated by degenerate traders looking to 100x their portfolios.

Dopex 1

Characteristics of a Strong Protocol

The protocols that push DeFi to the next level will capitalize on all three characteristics, leveraging their unique products to expand across DeFi and creating flywheels of their own. Let's examine this and discover what a protocol needs in order to be a part of the upper echelon of DeFi.

Dopex 2

• Adaptable Composable products allow for faster and more efficient technical development, but protocols must also be flexible to grab users' short attention spans. It is well known that DeFi is a rapidly changing sector that never sits still for long. Just as soon as DeFi 2.0 had intensified and OHM was making all-time highs, the market lost interest and DeFi once again experienced a period of extended drawdowns. Protocols need to be flexible and willing to adapt to improve user experience.

Even if DeFi eventually morphs into something entirely different from its current landscape, protocols that innovate and change their product based on user needs have the opportunity to remain a standing power. Similar to how Trader Joe separated itself from the fact it was a Uniswap fork and found huge success on Avalanche, protocols that adjust and remain building have the chance to expand into various subsets of crypto previously unimaginable. DeFi is no longer a small series of interactions between mercenary farmers searching for yield — it's a battlefield spanning across dozens of chains comprising hungry degenerates ready to hop ship to the next protocol at a moment's notice.

• Interoperable Once protocols figure out how to take advantage of composability and adaptability in their product development, they must focus on expanding beyond their native DeFi ecosystem. Previously, protocols were built on a particularsome L1 and only lived on that chain. However, the power of interoperability allows value and information transfer between different networks — enabling protocols to widen their moat.

In an ideal world, every protocol should strive to accommodate all three characteristics, but not even Curve checks all of these boxes. How did it manage to become such a powerhouse of DeFi and create a new DeFi primitive? Curve succeeded by doing what no protocol had done before — i.e. offer cutting-edge token engineering, governance mechanisms, and a useful governance token on top of a one-of-a-kind product.

Many consider governance worthless as current models are often sloppy or skewed in favor of those with the most tokens. Curve fixed this by offering incentives to make governance tokens useful, this coming as boosts. The veToken meta took DeFi by storm for a few months and allowed Curve to reach higher revenues, grow TVL, and represent interoperability and flexibility. Even with little composability, Curve made up for this by letting Convex do its dirty work, further amplifying the flywheel effect and producing the fabled open loop system.

Baseplate Thesis

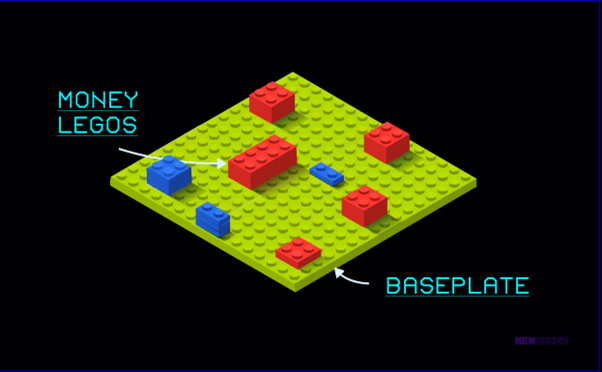

The Baseplate Thesis was first described by @0xSami_ in this article, outlining the relationship between a DeFi protocol and its total addressable market. By building off the foundations of the Fat Protocol Thesis, first written about back in 2016, Sami examined the meteoric rise of Curve Finance. Sami describes Curve Finance as a baseplate in which legos - analogous to defi applications - are built off.

Dopex 3

Crypto is a sprawling asset class encompassing everything from metaverse real estate to AMMs that handle billions in volume each day. Because of the diverse nature of defi protocols and applications, the landscape has developed into a string of microeconomies — most visible through Curve Finance and its relationship with Convex Finance.

By building off the characteristics that power the Baseplate Thesis, Curve turned itself from an AMM competing with Uniswap into a game-changer that sparked an entire war. Through valuable governance tokens, innovative tokenomics, and a war chest of over $20 billion in TVL at its peak, Curve transformed itself from an application to a protocol of its own — a baseplate built on Ethereum.

Even though the Baseplate Thesis is a concept that wasn't defined until a few months prior, the idea had been in formation since Curve's inception. Nobody had thought to imagine a scenario where a defi application could find enough success on its own to transcend boundaries and elevate to the status of a protocol microeconomy. And you can’t blame the majority of crypto participants, as the L1 boom was surging and applications with very little infrastructure were getting bid to unimaginable valuations.

Sure, the protocol's founders might not have imagined the entire DeFi space would become enthralled with veCRV and fight to control vast amounts of it, but this is a feature, not a bug. The veTokenomics meta doesn't work with every application, no matter how hard the developers try to shoehorn it in. Curve served as the most efficient AMM for stablecoin swaps, yet they made their way into becoming a battleground of every major DeFi protocol. How does this happen?

It's essential to have a product that people want to use. This can't be a Uniswap fork that's running liquidity mining incentives to gain TVL, or another Olympus fork that's promising a 10-figure APY. There needs to be a useful product that users will flock to and deposit money into out of their own interest. While many DeFi protocols can run hot for a while and hold a decent amount of runway to stay afloat, these aren't the hallmarks of a future baseplate. Curve didn't hope to make a quick buck and cash out. The team continued building and creating a name for themselves as the AMM that offers the lowest price impact on stablecoin swaps. If the TradFi retail options fever has been any indication, on-chain options in crypto will become an enormous market, one that could use a baseplate protocol of its own.

Dopex as a Baseplate

Dopex 4

Dopex wasn't looking to create a novel application on Ethereum, migrate to Arbitrum and fade into oblivion. They've done the opposite. Examining the protocol's documentation, you can find an explanation of their product offerings and their tokenomics. DPX is the primary governance token that accrues protocol fees, but Dopex created an additional token that keeps its user base in mind, this being rDPX.

DPX isn't just another useless governance token: it offers holders the ability to set the strikes for various pools and re-adjust weights of rDPX given to pools. Not only does this foster a more fairly priced options market, but it also offers an incentive to holders beyond the prospect of price going up. Governance has primarily been an issue among almost every DeFi protocol, but Dopex's complex suite of products provides a tangible need for governance as options are more complicated and require more delicacy than votes for an AMM might.

DeFi users care about return on investment and spend their time using protocols that will help them expand their bankroll. While options might end up paying out huge sums to those who buy OTM calls in TradFi, crypto - and especially DeFi - is a different game.

Even though Dopex is an on-chain option protocol, this doesn't mean you can navigate to their website and buy calls or puts on just anything. DeFi is in its infancy, meaning that current on-chain options protocols are less developed. Dopex offers option pools and SSOVs, two different strategies for investors. Currently supporting a variety of assets with everything from gOHM to CRV, Dopex focuses on providing its users with a healthy yield that requires minimal active attention. Provide liquidity for a pair of assets in an option pool and earn a yield, or experiment with SSOVs and lock up your assets to sell calls or puts on them. It's that easy.

Dopex has even been experimenting with a new options/DeFi primitive known as Atlantic Options. These are an entirely new product that hopes to improve the protocol's flexibility to give users even more control over their assets. Atlantic Options allow users to mobilize their collateral by depositing the underlying token to take advantage of their previously locked capital. Offering the ability to take advantage of more complex strategies like stablecoin insurance (with margin), nested puts, and no-liquidation borrowing means Dopex is moving toward on-chain structured products.

As Dopex expands its offering of more complex financial products like Atlantic Options and continues the development of SSOVs, the protocol becomes more attractive to institutional investors looking at DeFi. As TVL continues to increase and Dopex builds out its suite of products, holders of veDPX stand to benefit from this explosion of protocol revenue and fee accrual.

Could this become the catalyst that sparks a fuse and ignites the Dopex Wars?

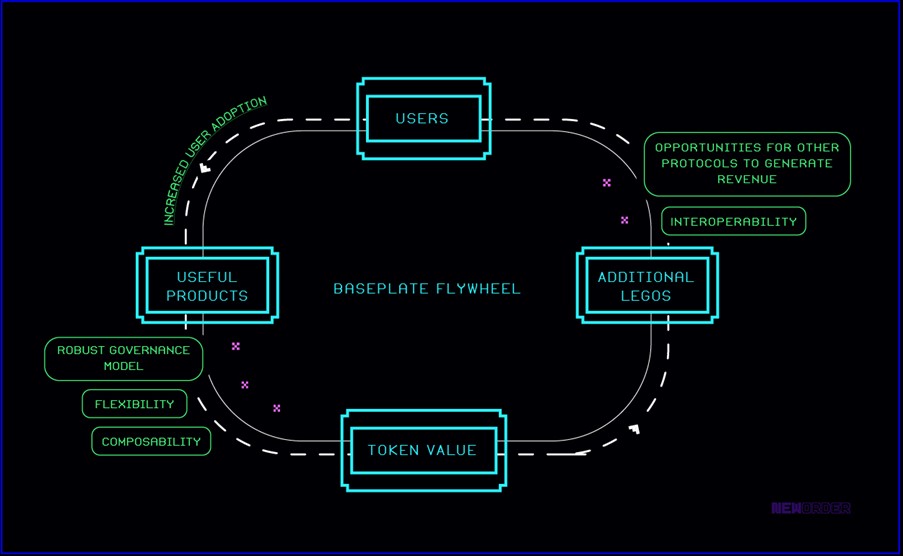

After examining Dopex's unique qualities and characteristics that differentiate it from the competition, the picture becomes more apparent — a future where Dopex stands as a baseplate of its own. Creating a robust governance model and product offering will mean it’s only a matter of time until users flock to the protocol.

Once this happens, a war will not happen by chance. No, Dopex must create a flywheel effect by instilling the baseplate ideals: flexibility, composability, and interoperability. By doing so, protocols will accumulate DPX (or rDPX) to strategically position themselves to benefit from the future money that will flow into the protocol. Just as Convex accumulated CRV and became a money printer, protocols looking to capitalize on the expansion of crypto options can focus on the long-term and establish themselves atop Dopex's baseplate.

Dopex is igniting DeFi derivative wars

Dopex 5

Already, we've seen Dopex begin its inevitable process of transitioning from humble options protocol to DeFi powerhouse, a baseplate of many lego bricks to come. As the many narratives of DeFi continue to intermingle and produce increasingly complex variations of each other, on-chain options seem like a logical next step.

Whether or not Solidly succeeded in bring the Curve Wars over to Fantom, a new crop of forks seem to be bringing the Solidly Wars back to life. With the much-anticipated release of Evmos, a serious inflow of money from the Cosmos ecosystem might find its way over to Arbitrum (an Ethereum Layer 2) and wind up on Dopex.

If Dopex is able to integrate additional protocols on top of itself and transition to a baseplate, this could be more than enough to send DeFi into yet another war.

Knower and Mitch can be found on Twitter at @knowerofmarkets and @mitch_schneids

Published on Jun 01 2022