Interest Rate Swaps with Voltz Protocol

What is Voltz?

Voltz is an exchange specializing in swaps between variable and fixed interest rates on their aptly named vAMM (variable Automated Market Maker).

But first, what is an Interest Rate Swap (IRS)?

An interest rate swap is an agreement between two parties to exchange one stream of interest payments for another over a set period of time. Interest rate swaps usually involve the exchange of a fixed interest rate for a floating rate, floating for fixed, or floating for floating. The goal is to reduce or increase exposure to fluctuations in interest rates or to obtain a marginally lower interest rate than would have been possible without the swap. Rates are generally based on the Secured Overnight Financing Rate, and payments made to either party are based on that index rate combined with the spread.

Interest rate swaps have three notable uses:

- To hedge potential exchange rate losses

Example: A US-based multinational business that does business in Ireland expects a decline in the value of the EUR throughout the year.

- To manage credit risk

Example: An investor who owns a variable rate structured product expects lower returns over the next couple years and wants to fix the future income streams at a higher rate.

- Income generation through speculation

Example: A hedge fund receiving a fixed rate on treasuries expects there to be future a future increase in rates, and so swaps its fixed rate for a variable rate to take advantage of the increase

Walkthrough of an Interest Rate Swap

Let’s stick with the fixed-to-variable example. In this case, an IRS has three parties involved: the fixed taker (FT), the variable taker (VT), and the market maker(MM). The IRS is birthed when either the FT or VT wants to manage their cash flow position over a set period of time.

Using the illustration below: let's say Party One is a US-based firm and is receiving fixed payments in EUR throughout the year. Due to the EUR having higher inflation, they would like to hedge a potential decline in the EUR/USD exchange rate. This would make Party One the VT. Party One goes to the market maker and offers up his fixed rate, Party Two, the FT, offers up their variable rate, which is based on a rate index.

In this transaction, Party One will pay Party Two its fixed rate in return for the variable rate. Should inflation rise in the EUR, and should the expected rate increase follow, the VT would make a profit and be unaffected by the currency exchange rate change. Meanwhile, the FT would report a loss and the market maker would receive a cut of the transaction.

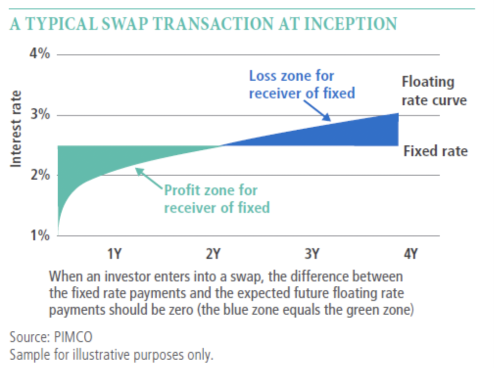

A Typical Swap Transaction

So now that I know how an IRS works, how does Voltz implement them?

Voltz’s approach is to create a decentralized marketplace where market makers (LP’s), fixed takers, and variable takers can trade, lever, and manage positions on single assets through concentrated liquidity.

The Voltz Dashboard

How Voltz works:

While traditional interest rate swaps can occur between a number of different players, Voltz currently allows swaps between fixed takers and variable takers. First, users decide which role they will fill: Fixed Taker, Variable Taker, or Market Maker.

Fixed Taker:

The FT trades their variable rate to lock in a fixed rate when they believe that future rates will decline. This is a “risk-off” position and the player must deposit enough margin assets to cover the variable rate payments during the contract period.

Variable Taker:

The VT trades his fixed rate for a variable rate whenever he believes that rates are going to go higher. The VT is also able to leverage their position 10x-50x, which enables him to benefit from future rate rises. This of course is a much more aggressive position to be in, and thus will be predominantly used by sophisticated traders or absolute degens.

Liquidity Provider:

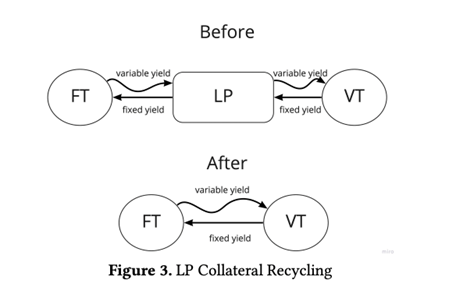

The LP deposits assets into the single asset liquidity pool and generates fees when the VT or FT are matched together and “consume” said liquidity. Voltz’s team refers to this as Liquidity Collateral Recycling, as can be seen below.

Source: Whitepaper

Traditionally speaking, an LP will facilitate both sides of the transaction. Under this method, should a match at a specified rate be found, the LP removes themselves from the equation, allowing the FT and VT to compensate each other directly. The LP receives fees from this as well, which is the ideal situation for them.

Of course, LP’ing is not without risks. Suppose a VT was unable to be matched. Who fills the role of FT for the trade? Well, the LP, of course. This is what Voltz refers to as funding rate risk. When the consumer of liquidity is not matched with another, the LP must act as the other party. Thus the LP needs to have a healthy amount of assets to minimize funding rate risk. Funding rate risk will result in a loss similar to the impermanent loss commonly experienced by traditional AMMs.

During the trade, Traders have the ability to lever up or unwind early depending on the rate environment. In the event that the variable and fixed rate are equal, either party may unwind the position and experience a zero net-cash flow. However, should the variable and fixed rate not be equal, then a situation like the earlier image emerges and either party must leave behind some margin to cover the upcoming cashflow payment.

How leverage works:

Leverage is by far one of the more interesting areas on this platform, since the volatility between rates can be a cause for concern regarding potential liquidations. The more leverage used, the tighter a spread around rate movement occurs. Meaning that smaller variances in rates can cause large payouts to either trader.

Liquidations:

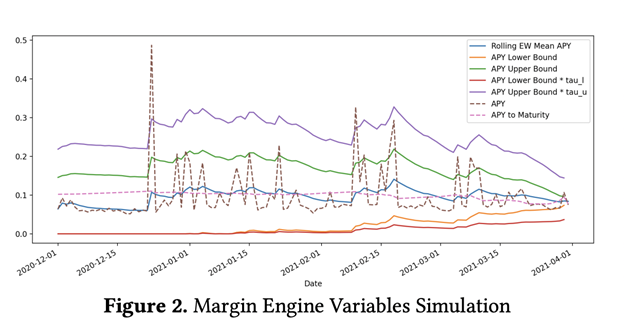

Given the nature of these markets, rates can move sporadically throughout the day and thus may be a cause for concern for those using high amounts of leverage. Voltz tackled this problem by triggering liquidations only if the VT/FT is out of margin consistently on a per block basis. So, short term rate variances that mean revert will not be an issue.

Something I would like to note here is that this mechanism actually puts a lower bound on rates so that they will never be negative. This is a commonly occurring problem in the traditional industry, as generally a prime broker will call up the under-margined party and request additional funds to bring it back up to par.

Margin Engine Variables Simulation

Conclusion

One thing I was hoping to see was the ability to do cross asset rate swaps. This would enable traders to potentially hedge cash flows by locking in the rate they receive, rather than just speculate on single asset rate directions. Perhaps Voltz will offer this in the future, but there’s no way to know for now. Overall, interest rate swaps are highly useful and Voltz has designed one hell of a platform for bringing this modern financial tool to DeFi. It’s an exciting development and we look forward to seeing what they’ve got in store down the road.

Published on Jul 29 2022

Written By:

blk_7wan

@blk_7wan